🏦 How slave trade was "too big to fail"

...and how it fuelled the US economy, but fostered a brutal capitalist culture

👋 Hi all 👋👋👋 I’ve written a piece on how the American slave trade was “too big to fail”, in the same way that modern day banking is—and how this led to a brutal capitalist culture.

Credits: Frederic Hache, finance-watch.org

At the height of slavery in the US, the total value of all slaves was worth more than all factories and railroads combined.

I listened to 1619 this week 🎧 a New York Times podcast on how slavery built the American economy.

In 1837, the economy crashed in a similar fashion as in 2008. During the Panic of 1837, as it’s been coined, the supply of cotton was too high and demand couldn’t keep up. This led to falling prices 📉 and to plantation owners who couldn’t pay back their debts. In response, the American government could have raised taxes or claimed their farms, but they did neither, because raising taxes was unpopular and foreclosing plantations would essentially mean closing the economy.

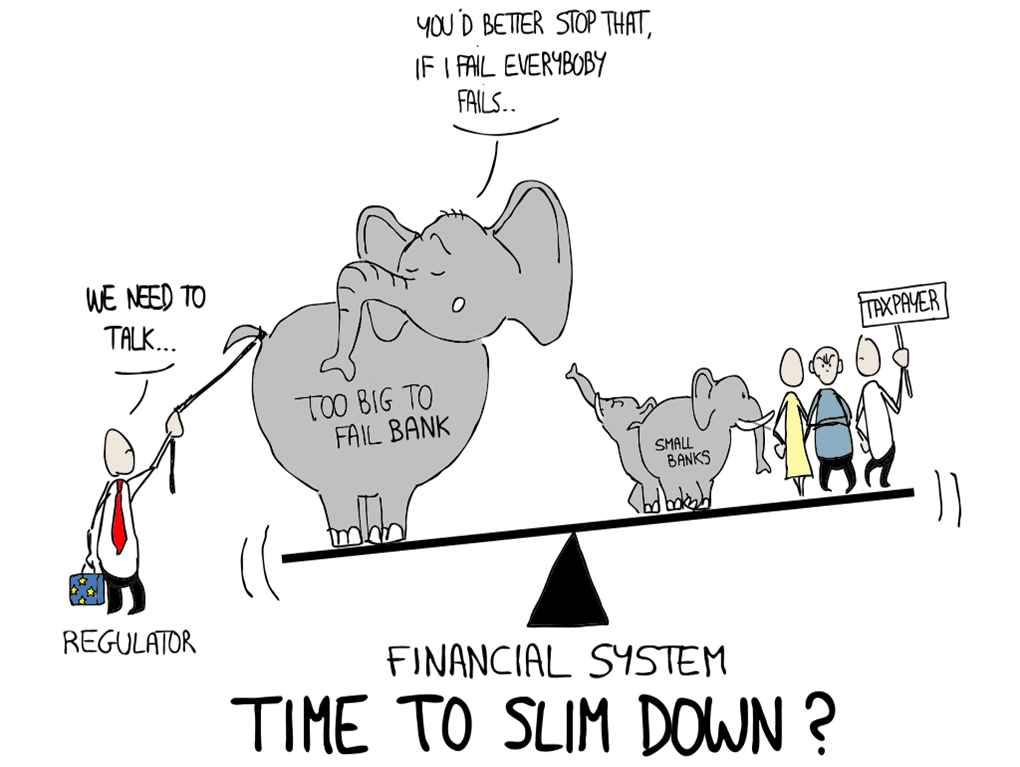

Because the slave industry was too big to fail.

Sounds familiar? In 2008, the American government bailed out banks because they were too important for the economy, an unshakable industry—they were too big to fail. Allowing banks to go bankrupt would have devastating effects globally due to mass unemployment and lost pensions.

👉 Enjoying this week’s post? Share it with friends 👈

What allowed the US to become the leading nation in the world, also fostered a brutal capitalist culture. This culture has led to a society where CEOs earn 200 times employees’ salaries 💸 where education indebts you for years and years 😓 where healthcare is a luxury 😷 and where the economy is allowed to crash again and again and again 💥

This happens because companies are allowed to do as they please; for example, issuing mortgages regardless of personal finances or aggressively lending money to plantation owners. When the bubble bursts, there is impunity for the profiteers—the government bailed out the borrowers after 1837, and bailed out banks after 2008. This happens because executives know that if they screw up, their elected leaders will cash them out.

A few weeks ago I wrote about how bankruptcies are an important ingredient in a healthy economy. Risk-taking is part of business, but companies and their executives must carry the consequences of their decisions. If not, they’ll keep making the same irresponsible decisions 🔁 ♾️